Commentary

December 2nd, 2020

NOVEMBER INSIGHT REPORT

November Bankruptcy Filings Hit 14 Year Low - November 2020 Bankruptcy Data

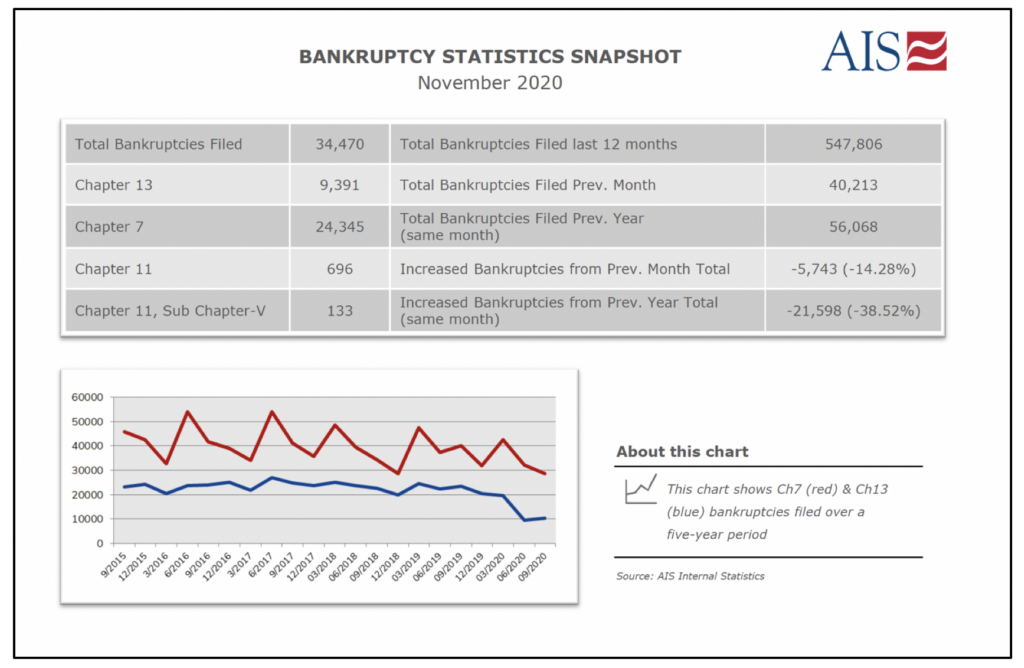

November bankruptcy filings totaled 34,470, marking the lowest monthly total in nearly 15 years. The drastic decline in filings can be attributed to stimulus checks, unemployment benefits and mortgage and student loan deferments. Although we observed a decrease in overall filings, our analysis revealed a 40% increase in Chapter 11 when compared to November 2019 data (Figure 1).

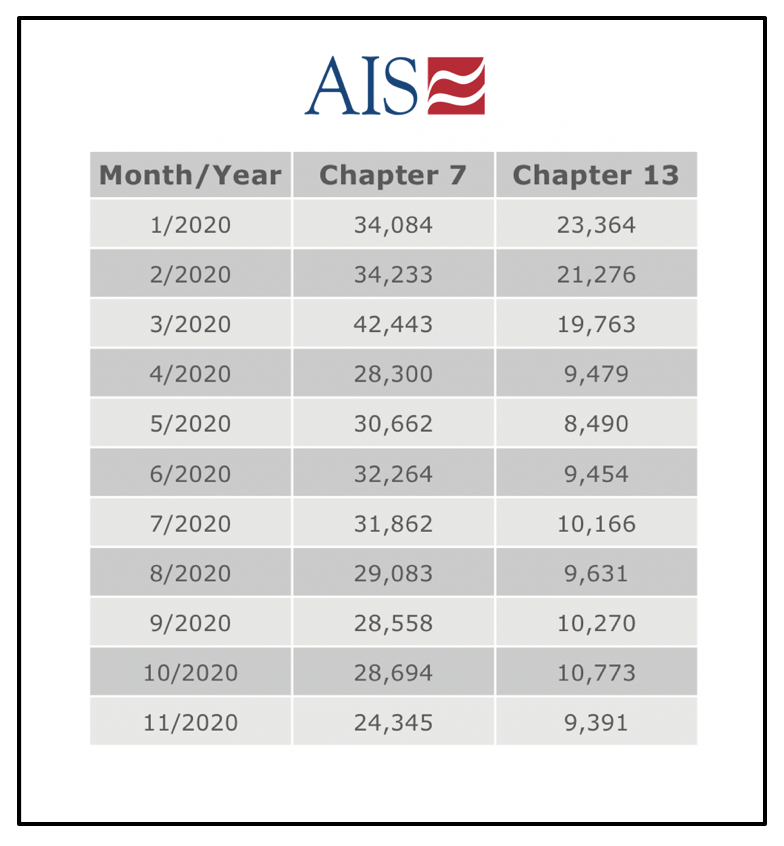

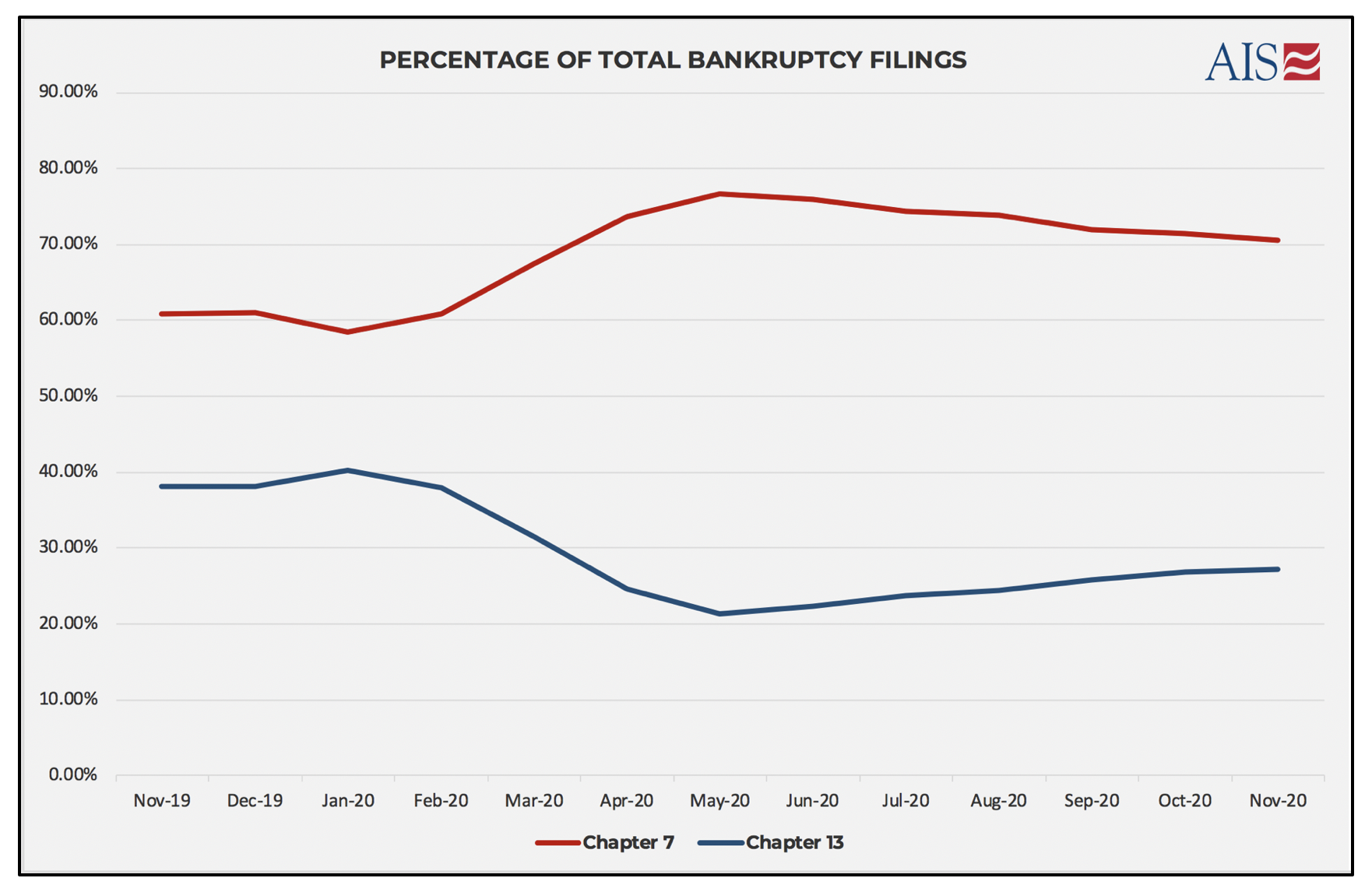

Our November analysis of Chapter 7 and Chapter 13 bankruptcies revealed that filings are still well below the monthly averages (Figure 1). Chapter 7 bankruptcies yielded a 29% decrease from the 34,331 filings recorded in November 2019 (Figures 2 & 3). Chapter 13 bankruptcies reflected a 55% decrease from the 21,190 filings in November 2019 (Figures 2 & 3).

Figure 1

Figure 2

Figure 3

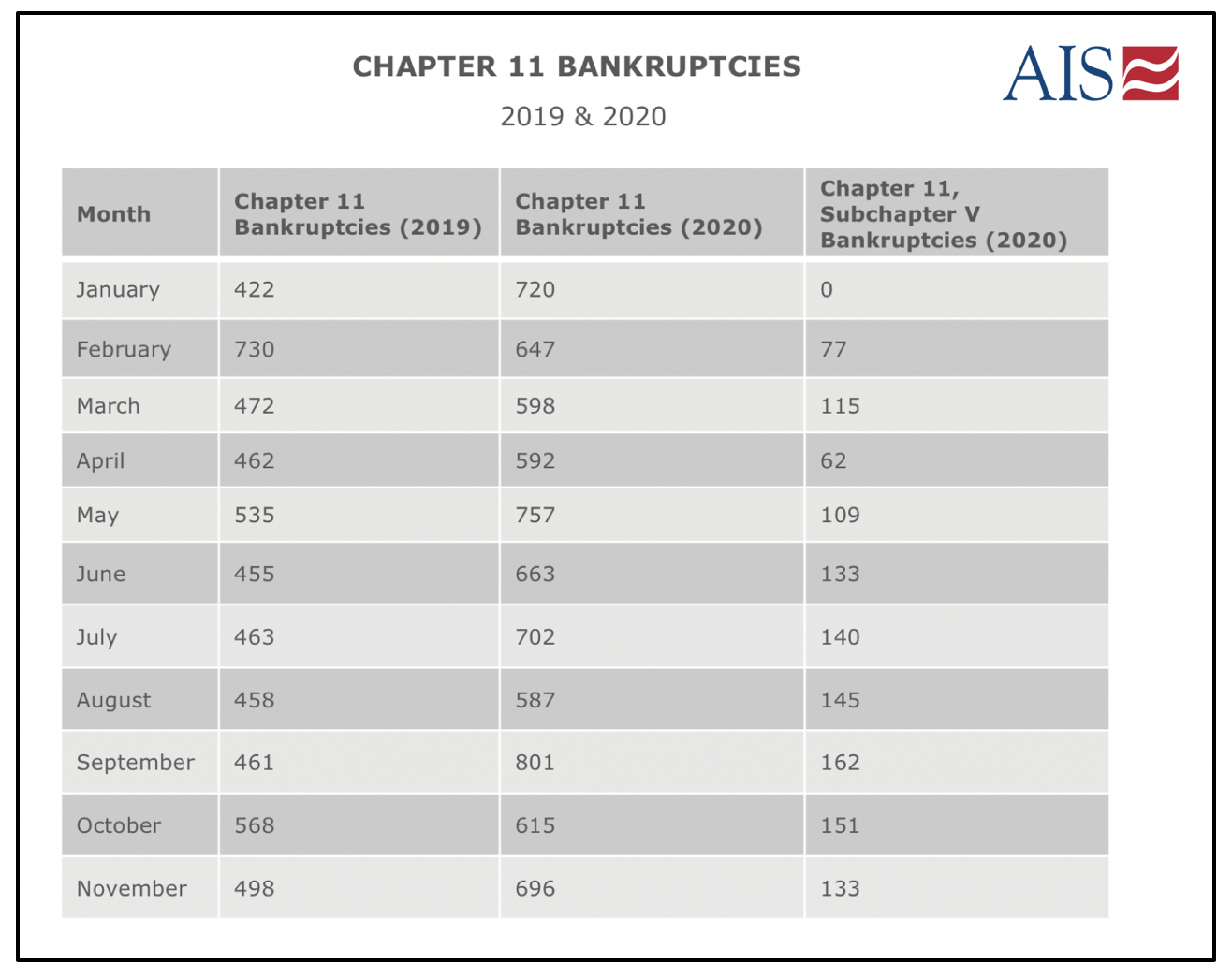

November Chapter 11 bankruptcies increased by 40% as compared to November 2019 (Figure 4). Chapter 11 bankruptcies totaled 696 in October 2020 as compared to a total of 498 filings in October 2019 (Figure 4). In our month-over-month analysis, we observed Chapter 11 filings have increased by 13% and Chapter 11, Subchapter V filings have decreased by 12% (Figure 4).

Figure 4

Figure 5

Figure 6

The highest percentage of bankruptcies for September 2020 came from the South (East) (28%) followed by North Central (East) (19%), Pacific (14%), South (West) (14%), Northeast (12%), Mountain (7%) and North Central (West) (6%) regions of the country (Figure 7).

Figure 7

As mentioned in previous months, data confirms that 2020 continues to be an unusual year (Figure 8). A five-year analysis of bankruptcy filings shows a major trend deviation.

Figure 8

The federal moratorium on foreclosures and evictions imposed by the Federal Housing Finance Agency (FHFA) and CARES Act was set to expire on December 31st, 2020. The FHFA recently revealed that they would extend moratoriums on single-family foreclosures and evictions until at least January 31, 2021. Experts believe this will add to the growing backlog of those who would otherwise be forced to file for bankruptcy protection.

To download the full November Insight Report, click here.