Commentary

October 5th, 2021

SEPTEMBER INSIGHT REPORT

Chapter 13s Continue to Rise as Bankruptcies Remain at Historic Lows

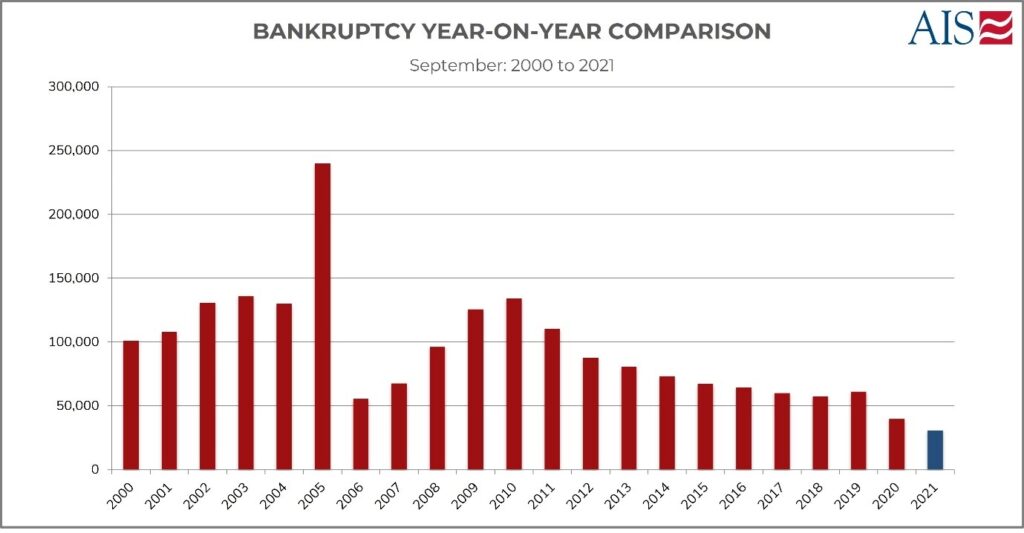

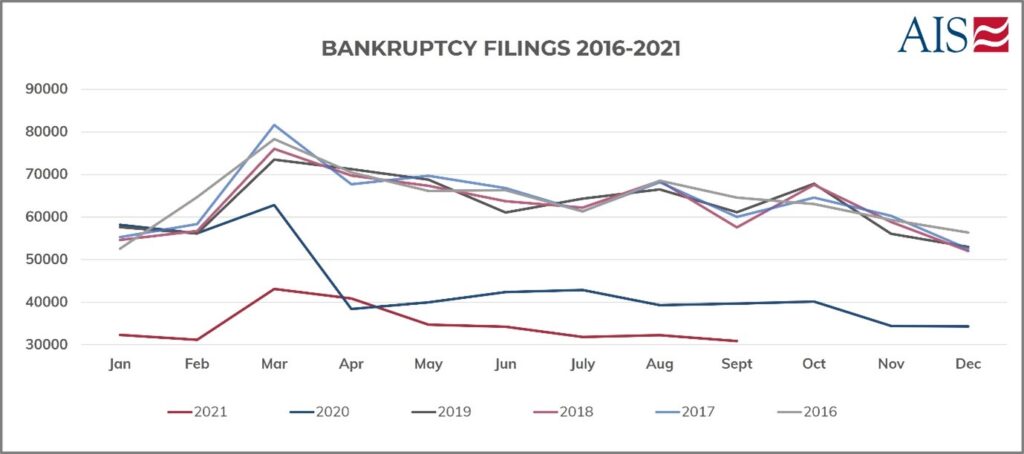

According to the latest AIS Insight Report, September bankruptcy filings totaled 30,914, marking a year-over-year decrease of 22% and a 49% decrease when compared to pre-pandemic data (September 2019) (Figure 1). This is the lowest September number we have seen in over 20 years and the smallest monthly total since January 2006. However, Chapter 13 filings have risen each month since May, reaching 10,283 in September (Figure 1). The 4% decrease from August to September is in line with the seasonality we see each year with filings (20-year average of -3%).

Figure 1

Figure 2

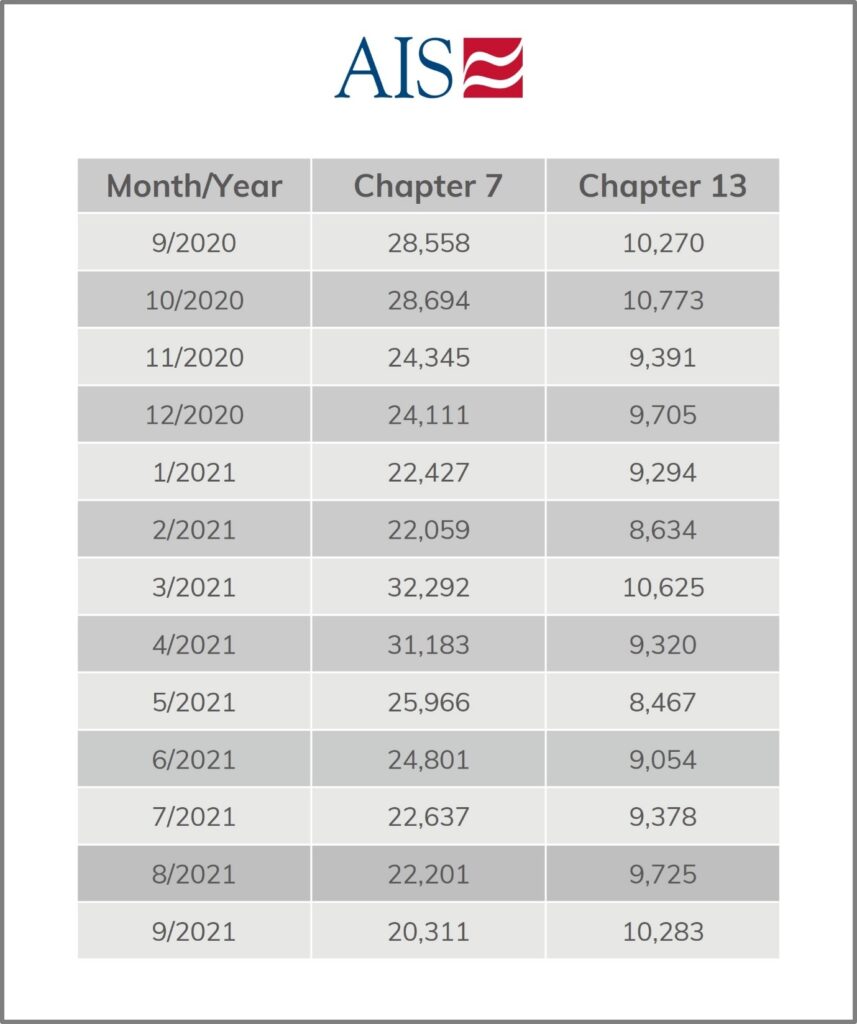

Figure 3

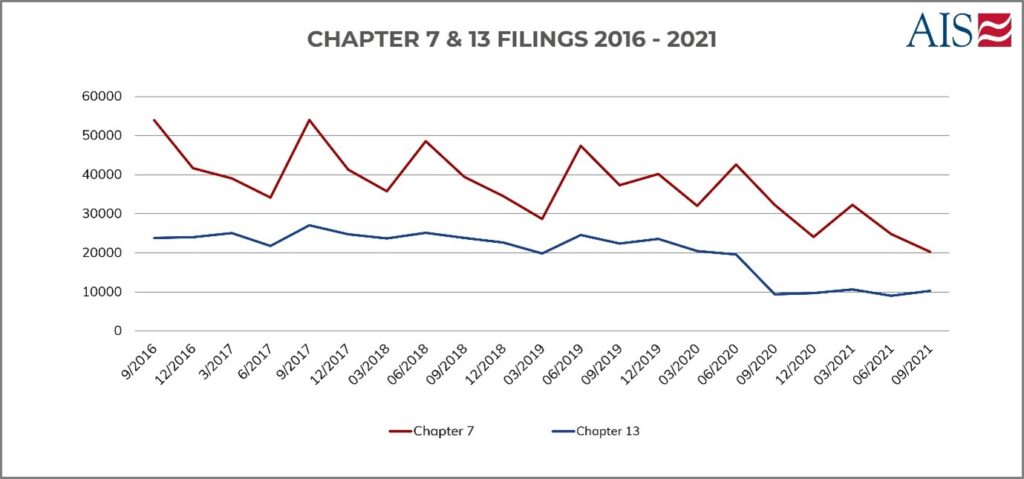

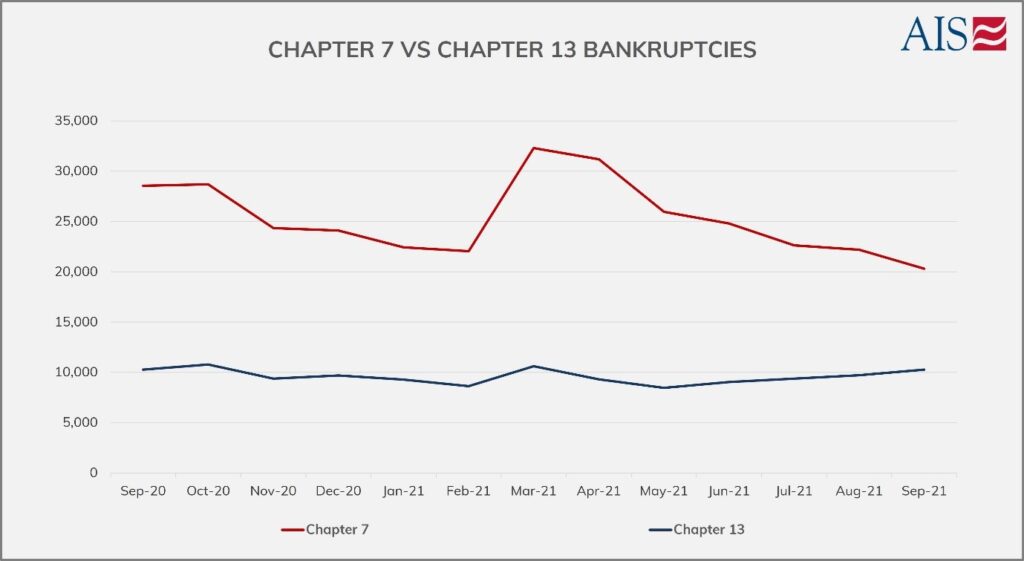

Our analysis of Chapter 7 and Chapter 13 bankruptcies reveals that numbers continue to stay below historical averages (Figure 4). However, as we mentioned, Chapter 13 filings have risen each month since May, reaching 10,283 in September (Figure 4). At the same time, Chapter 7 filings have fallen each month since April hitting 20,311 in September 2021 (Figure 6).

Figure 4

Figure 5

Figure 6

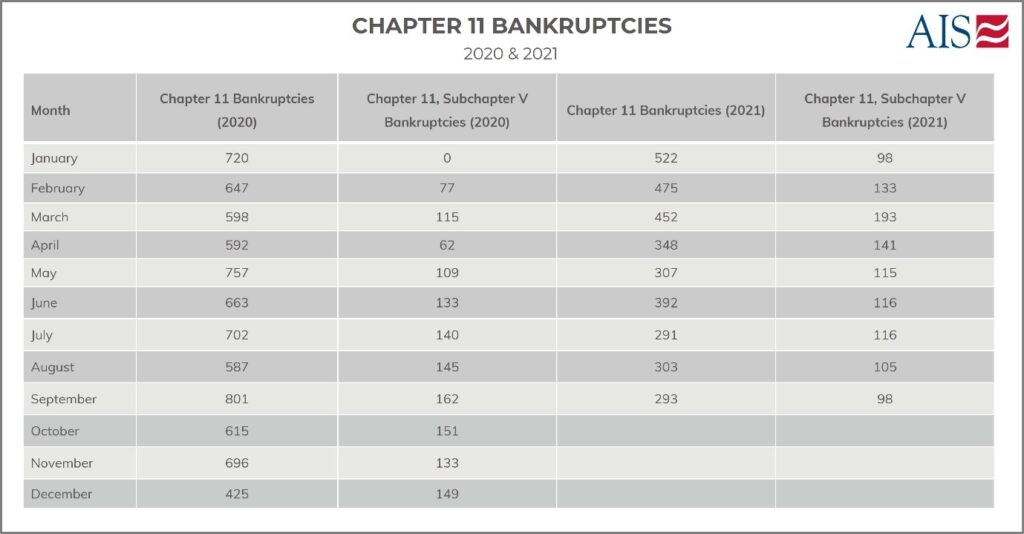

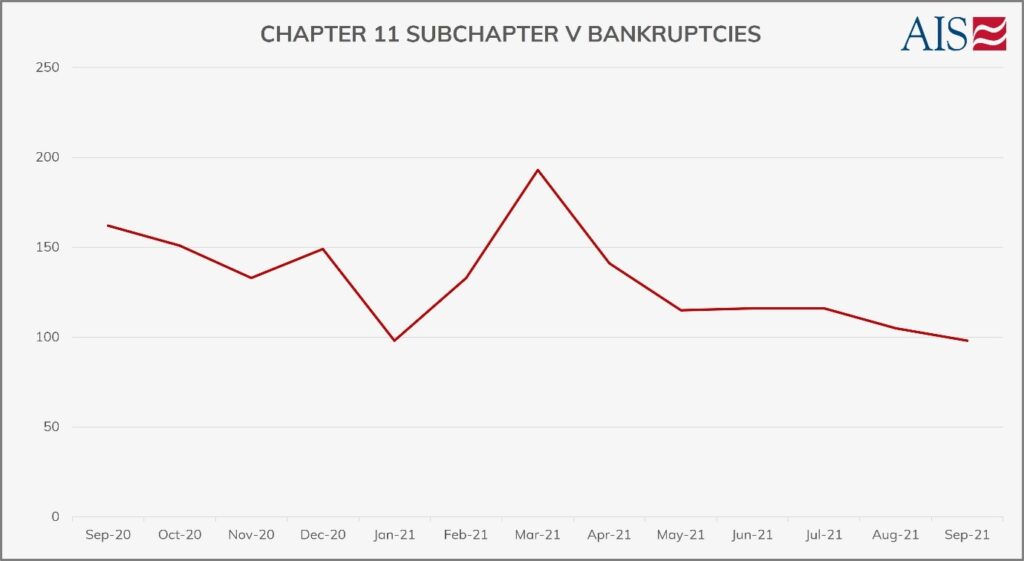

For the month of September 2021, Chapter 11 filings decreased 3% from August totaling 293 (Figure 7). The total also marks a 63% year-over-year decrease. (Figures 7 & 8). Chapter 11, Subchapter V filings continued to dip, hitting the lowest total since January (Figures 7 & 9).

Figure 7

Figure 8

Figure 9

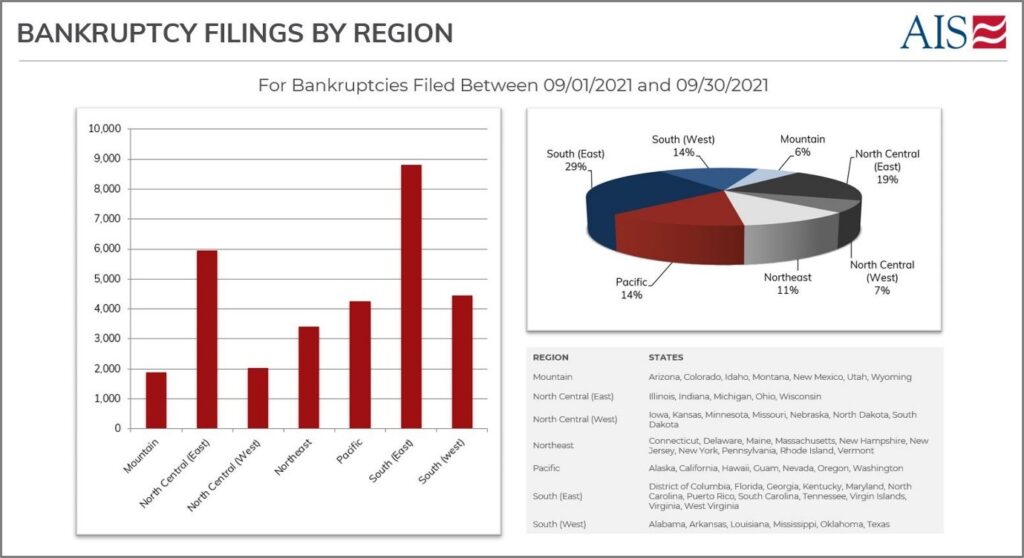

The highest percentage of bankruptcies for September 2021 came from the South (East) (29%), followed by North Central (East) (19%), South (West) (14%), Pacific (14%), Northeast (11%), North Central (West) (7%) and Mountain (6%) regions of the country (Figure 10).

Figure 10

It’s important to note that Federal and State programs like the eviction moratorium expired on September 20, 2021. This being said, numerous states will continue to have rent reimbursement programs in place that could stave off new bankruptcy filings as the moratoriums expire.

To download the September Insight Report, click here